Market Corrections

The market has had a tough go in 2022. Volatility has returned with a vengeance. However, while the market swings feel abnormal, the reality is that this is aligned with historical market norms.

How can we make sense of that? How can investors weather this storm?

What is Normal for the Stock Market?

Markets go up and down. Prices fluctuate. THAT is normal. And, within that pattern, there are inevitable market corrections that help prices return to justifiable levels. These corrections happen more often than the market behavior of the last decade may lead you to believe.

Stock market losses are a regular occurrence. Since 1950, the S&P 500 has had an average drawdown of 13.6% over the course of a calendar year. There have been over 30 double-digit corrections, 10 bear markets, and six crashes. This means a correction of 10% or more happens every two years or so and a bear market occurs nearly every seven years.

Just like the drawdowns that are common, so are the bounce-backs (obviously, markets trend higher over periods of time).

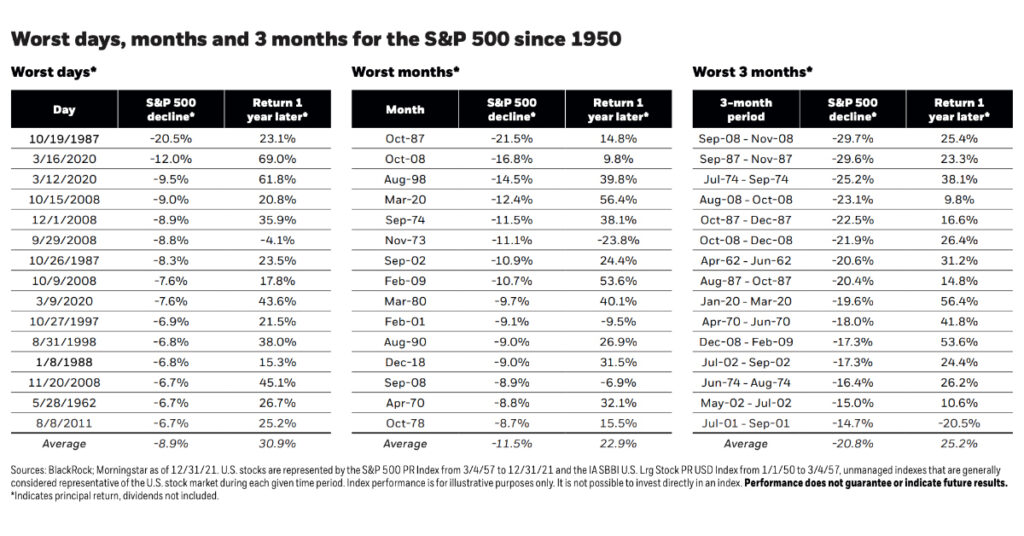

Take a look at this chart prepared by BlackRock:

Since 1950, whenever the markets encountered the worst three-month period, the average decline in S&P 500 was 20.8% and it was up 25.2% a year later. When you look at the worst days or a singular month, the numbers are even more encouraging.

Common occurrences are easily forgotten and washed away by the exuberance of unrealistic times.

We are experiencing a down market and most if not all the indices are in correction territory. That is inescapably true. It is equally true that these markets will stabilize and begin trending in the other direction.

Leave the Emotions Behind

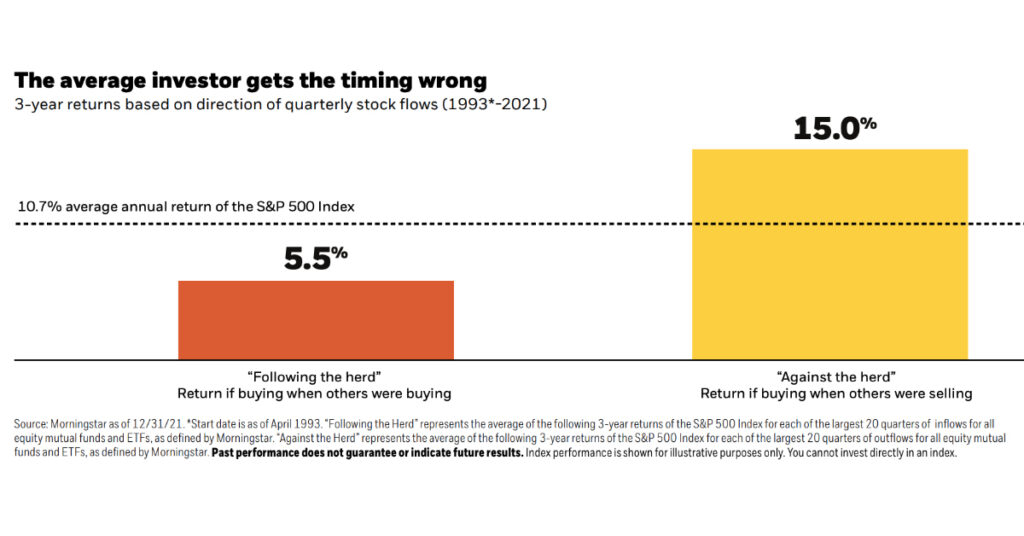

If corrections are common and bouncebacks are inevitable, why do individual investors lose money during a correction?

Two simple answers: first, they sell and convert a paper loss into an actual loss, and second, they let the market dictate their behaviors by fueling emotional responses. Your emotions have the potential to erode more of your wealth than any market correction ever will.

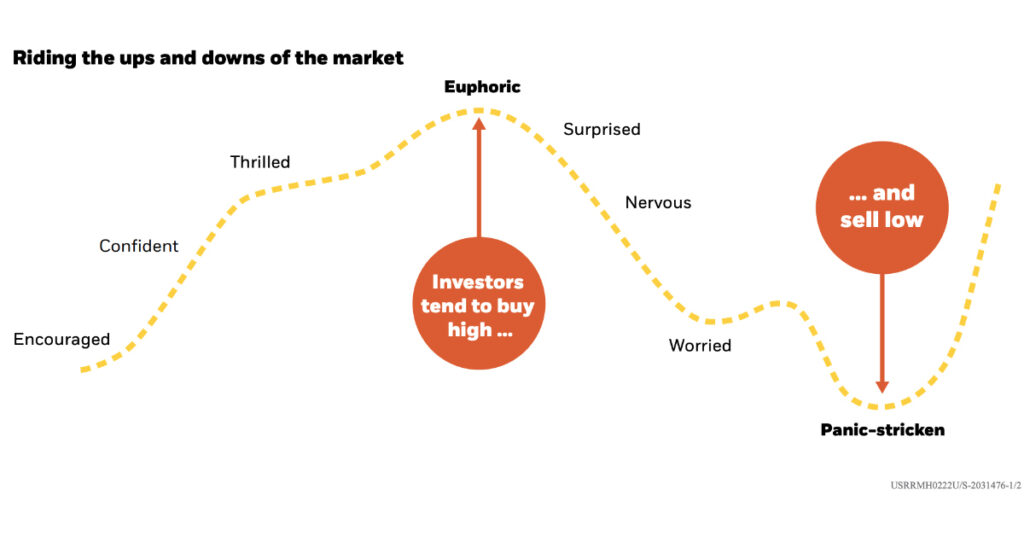

Let’s take a look at another chart by BlackRock. This is even more interesting. We all know that you should always buy low and sell high. However, most individual investors tend to do the exact opposite in conflict with their best interests: they buy when the markets are high, when the news is only positive, and they feel exuberant about stocks. They buy high.

Then, when markets correct and the momentum switches, fear sets in, panic takes over logic, and they sell at a low not only erasing their gains, erasing their wealth in the process. And most of the time, these investors completely miss the rebound while they are sitting in cash only to get back in the market when the recovery is well underway.

Market Volatility is an Opportunity

This is not the time to pontificate the virtues of compounding, staying invested for the long term and the folly of trying to time the market. However, we should place investing into perspective.

We believe in a very simple principle – be an investor and not a speculator.

What does that mean?

Speculation is risk. Speculation is, well, speculative.

Investing is about fundamentals. Is a company worth owning? Why is it worth owning? Will it be worth more later when I want to sell my shares?

These are guiding questions that help differentiate someone who invests in a company and someone who has a speculative gut feeling about an investment.

If you believed a company was worth owning at a higher price, and the fundamentals haven’t changed, why wouldn’t you want it and more of it at a lower price? Markets Corrections are like flash sales. If you like the merchandise, buy it cheap and watch patiently as it appreciates.

Volatility is also an indicator that there are buyers and sellers. If investors are buying the down market, they clearly realize that the future will be brighter than the present.

Turn Off the Pundits

The best way to Keep Calm and Carry On is to not pay attention to the pundits on news channels who make a living from dramatizing the news. Sure, headlines can be tough, and news can seem bad. But no one ever stays tuned to a channel if the pundit’s lead was, “Welcome to the show, everything is normal.” They make money off ads, and advertisers pay based on viewership. Fueling the viewers’ emotions on a regular basis is good for their business, not yours.

Election Year Affects Market Volatility

We are entering the mid-term election cycle. Typically, markets experience a decline leading into a mid-term election year followed by a sharp uptick, according to a study recently released by US Bank.

The political landscape usually shifts during a mid-term and that is clearly the expectation in 2022. The volatility might continue straight through until November. If history is any guide, the 12 months following November should be monumental to the upside.

Keep Calm & Market On

Investing is not smooth sailing. There are ups and downs. Good times and challenging times. America is facing some significant headwinds. Inflation is at alarming highs. The economy is shrinking as reflected in the recent GDP figure. The geopolitical landscape seems riddled with disasters from the war in Ukraine to COVID in China.

That being said, we have been here before. Economic, political, and market cycles repeat themselves time and time again. We have seen high inflation before. There have been wars. There has been political unrest. Markets have corrected and bears have woken from their slumber before. This is not new or novel. We just have forgotten how common these challenges can be.

During times like these, we need to remain focused, place events in perspective, and avoid the triggers that set our emotions off.

Reach out to us if you would like further help navigating the turbulent waters of market volatility. We are here to help!