Why do you need a financial plan? If you want a shot at achieving any of your goals, you need a plan to get there. Here’s how!

Continue readingTips for 2022 Tax Season

Here are four ways to help you develop strategies that fit your plan and reduce your tax exposure in 2022.

Continue readingRetirement Income – Developing a Plan

Develop an income plan for retirement with different sources. Here are a few tips on how to get started.

Continue readingTop 3 Tips for Making the Most of Your Inheritance

Check out our top 3 tips for handling your inheritance. Planning ahead for how you will use the wealth and any taxes.

Continue readingRobo-Advisor Vs. Human Advisor: Which One Should You Choose?

As financial planners, we can tell you most people need help investing – the only question is whether that help should be from a robo-advisor or human advisor.

Continue readingFinancial Conversation Tips for Couples

Communication about money is often fraught for couples, and bringing the topic up with your partner can be challenging. But discussing financial concerns, goals and habits is key to a strong relationship. And open communication about these topics can help you and your partner work as a team toward common financial goals.

Continue readingRMD Rules & Strategies: Five Minute Fundamentals Video

We discuss the RMD rules & the best strategies for handling your Required Minimum Distribution for a Traditional IRA account.

Continue readingFive Minute Fundementals: Why Work with a Certified Financial Planner?

Five Minute Fundementals: Dollar Cost Averaging

The market fluctuates, sometimes unpredictably, and often discipline and a steady hand are more effective than attempting a clever trading strategy. Dollar-cost averaging is a simple investing method that can help ensure that you invest regularly and buy more stock when prices are cheap and less when they’re expensive.

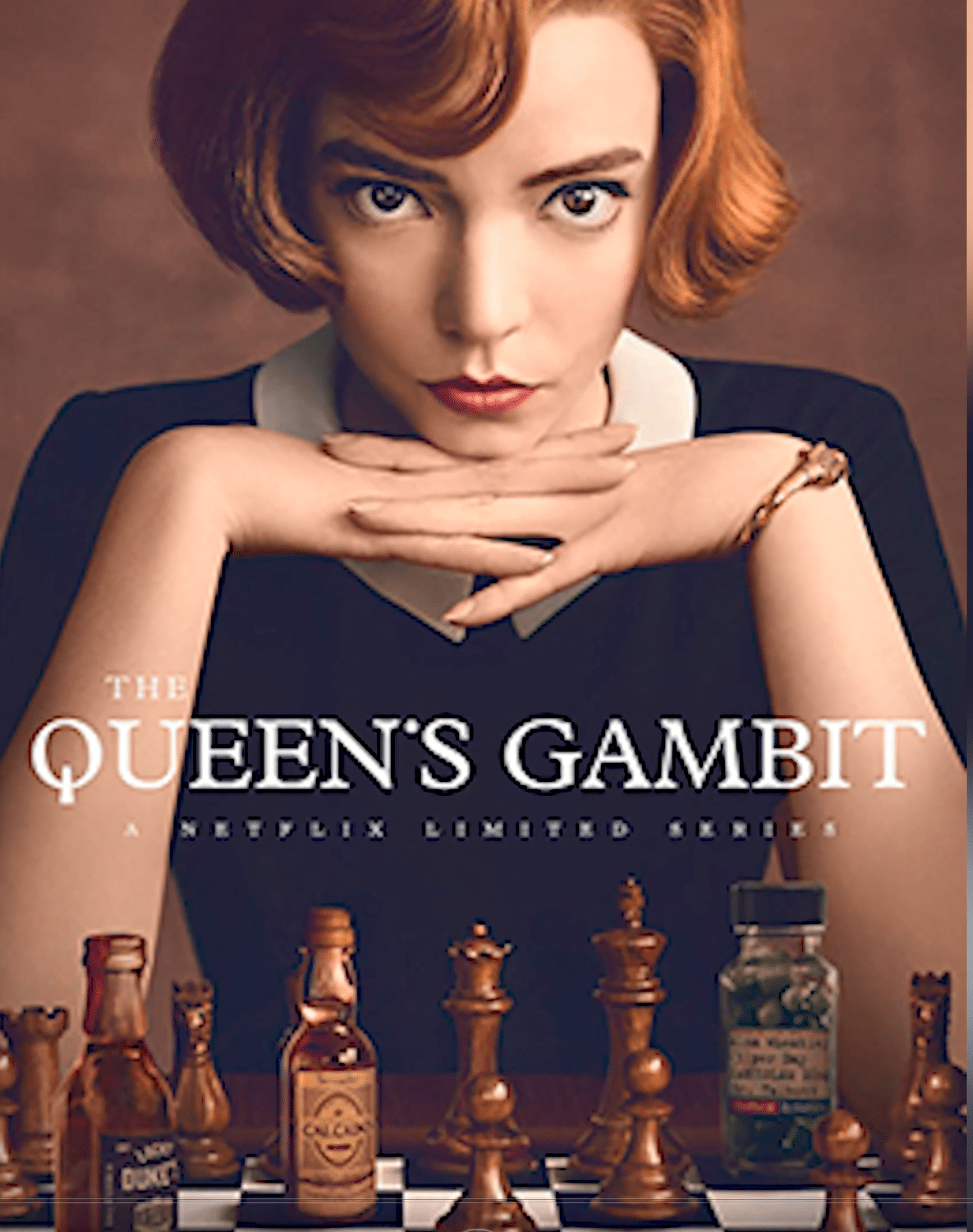

Continue readingWatch Now: What Lessons Can We Learn From Chess

Chess and your financial future.

Continue reading